How to open an LC

‘How to open an LC’ by buyer “procedures to open a Letter of Credit”

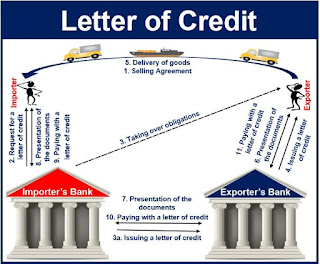

You (MR. A) entered into a contract with your overseas supplier to import machinery for production at your factory. As per your contract each other, you (MR. A) need to open a Letter of credit (LC). In this case, Letter of credit is opened by your bank (or other opening banks example: DBBL ) and beneficiary of the letter of credit is your overseas seller of machinery. Letter of credit is a guarantee given by DBBL bank (not you) to your buyer’s bank on account of your buyer. The amount under LC is transferred as per the terms and conditions mentioned in Letter of credit.

Procedures to open a Letter of Credit

MR. A can approach DBBL bank to open a Letter of credit. The concerned officer at DBBL bank helps you in filling up the necessary application to open an LC. Since the LC is opened on the basis of your purchase contract, a copy purchase order/export contract has to be produced with along with other required documents. DBBL bank may ask MR.A to keep a certain percentage of ‘margin amount’ with the bank.

What is ‘margin amount’ while opening Letter of Credit

DBBL bank is guaranteeing the payment. In turn, what guarantee MR.A providing to bank against the amount of LC? So a margin amount is blocked in your bank account to make the payment under the said letter of credit. This amount is determined, purely based on your financial relationship with your bank.

Thank you so much for such a wonderful blog. I’m really thankful to you for this informative…..

ReplyDeleteForeign letter of credit provider